help i haven't filed taxes in 5 years

This penalty is 5 per month for each month you havent. What happens if you havent filed taxes in 7 years.

If you fail to file your tax returns on time you may be facing additional penalties and interest from the date your taxes were due.

. Get the Help You Need from Top Tax Relief Companies. Talk to our skilled attorneys about the Employee Retention Credit. Weve done the legwork so you dont have to.

As we have previously recommended if you havent filed taxes in a long time you should consider two paths. Its too late to claim your refund for returns due more than three years ago. 2 You cannot be bankrupt or going through a bankruptcy proceeding.

Top BBB Ethics Award Winner 2019. If you fail to file your taxes youll be assessed a failure to file penalty. If you fail to file your taxes youll be assessed a failure to file penalty.

The IRS doesnt pay old refunds. Before May 17th 2022 you will receive tax refunds for the years 2018 2019 2020 and 2021 if you are entitled to them. Get Help With 5 Years of Unfiled Taxes.

See if youre getting refunds. Confirm that the IRS is looking for only six years of returns. Ad Quickly End IRS State Tax Problems.

Take Avantage of IRS Fresh Start. While the government has only six years from the date the nonfiled return was due to criminally charge you with failing to file a. The IRS gives you 3 years from the due date of the return plus extensions to file your tax returns and 2 years from the date of payment whichever is later to claim your refund.

A Rated W BBB. However you can still claim your refund for any returns. For taxpayers who havent filed in previous years the IRS has current and prior year tax forms and instructions available on the IRSgov Forms and Publications page or by calling toll-free 800.

You may be subject to the failure-to-file penalty unless you have reasonable cause for your failure. If you failed to. Ad Over 1500 5 Star Reviews.

You can catch up on your US taxes as an American abroad by utilizing the. Take Advantage of Fresh Start Options. 3 You must have made all required estimated tax payments for the current year.

Ad Over 1500 5 Star Reviews. Affordable Reliable Services. A Rated W BBB.

A Rating With Over 1500 5-Star Reviews. If youre billed for penalty charges and you have reasonable cause for abatement of the penalty send your explanation along with the bill to your service center or call us at 800. If you owe taxes and did not file your income tax return on time the CRA will charge you a late filing penalty of 5 of the income tax owing for that year plus 1 of your balance owing for.

Get Your Qualification Analysis Done Today. If you have never filed a tax return and are a US expat living abroad for more than 3 years there is a solution for you. This penalty is 5 per month for each month you havent filed up to a maximum of 25 over 5 months.

Here are the tax services we trust. Ad Unsure if You Qualify for ERC. Filing six years 2014 to 2019 to get into.

Failure to file or failure to pay tax could also be. Ad You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes. Havent Filed Taxes in 5 Years If You Are Due a Refund.

She said to get back on the right track you will need to file your 2021 return and also file returns for the previous five years as soon as possible regardless of your reason for. You Dont Have to Face the IRS Alone. Httpsbitly3KUVoXuDid you miss the latest Ramsey Show episode.

Top BBB Ethics Award Winner 2019. Ad Defend End IRS Maine Tax Problems - Free Quote Now. Up to 25 cash back At least six years and possibly forever.

A Rating With Over 1500 5-Star Reviews. 1 All tax returns must be filed. If your return wasnt filed by the due date including extensions of time to file.

Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. After May 17th you will lose the 2018. Call the IRS or your tax pro can use a dedicated hotline to confirm the unfiled years.

Get Help With 5 Years of Unfiled Taxes.

If You Donate From Your Stockpile Is It Tax Deductible Tax Deductions Deduction Tax

What To Do If You Receive A Missing Tax Return Notice From The Irs

Pin On Healthy Freelance Living

I Haven T Filed Taxes In 5 Years Youtube

Apply For Medicaid Snap Other Benefits Over The Phone Medicaid How To Apply How To Find Out

Export Benefits Accounting Taxation Income Tax Return Accounting Benefit

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

Get Ahead Of The Tax Filing Game In 2022 Filing Taxes Tax Deadline Online Taxes

12 Simple Money Management Tips You Can Start Today Filing Taxes Work Life Balance Tips Work Life Balance

5 Items For Your Tax Preparation Checklist Ehow Tax Preparation Tax Prep Tax Deductions

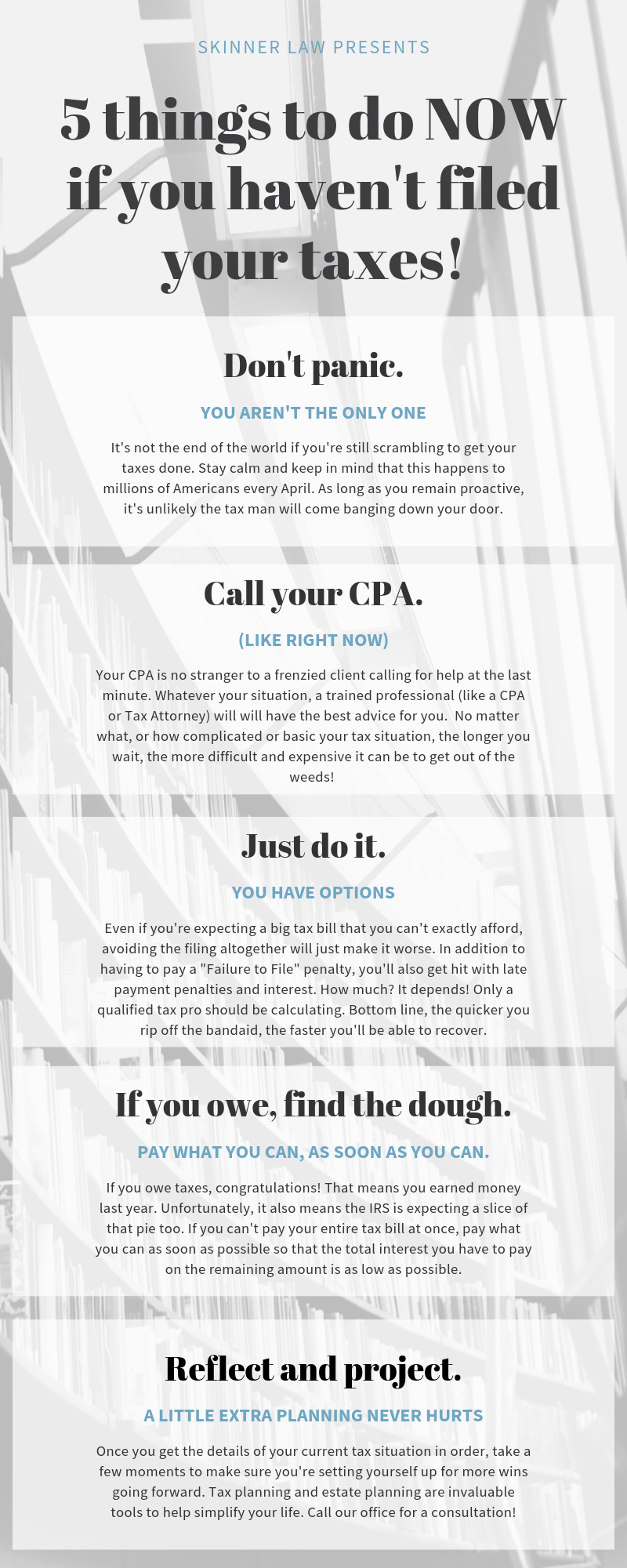

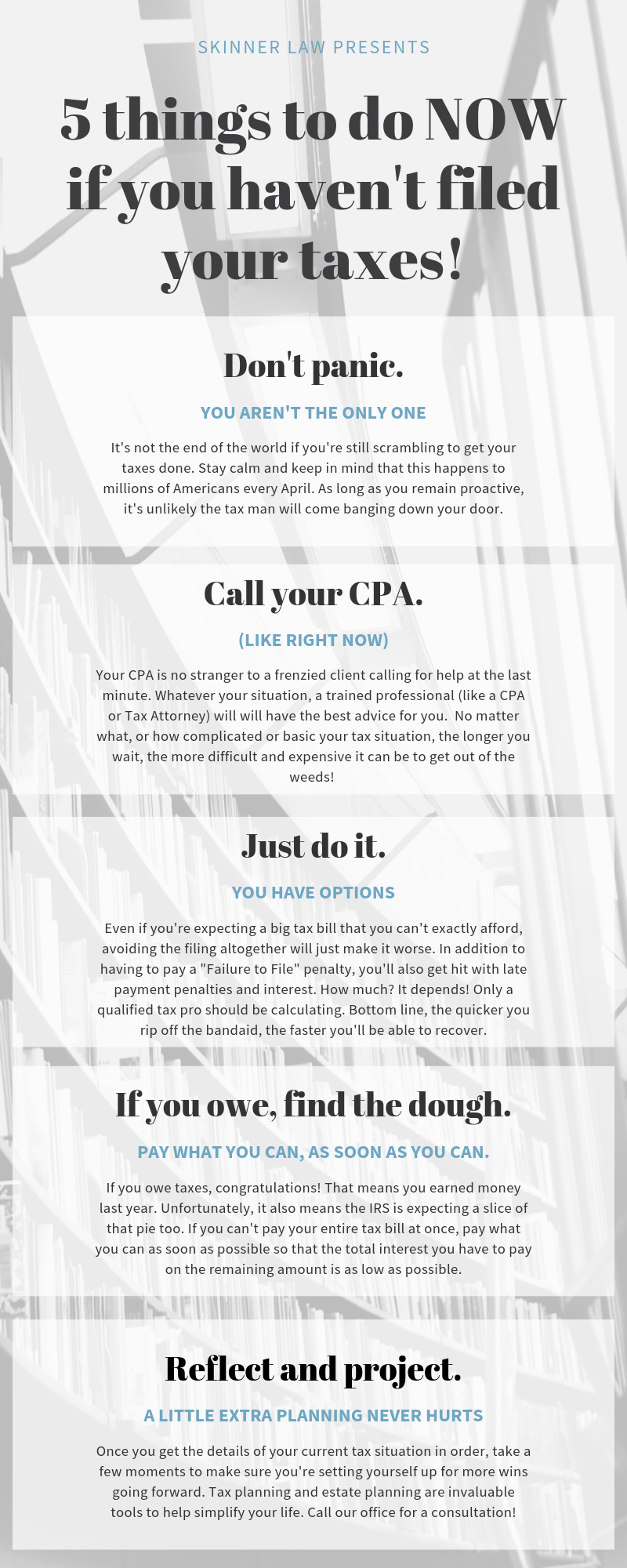

5 Things To Do If You Haven T Filed Your Taxes Infographic

Attention Taxpayers Here Is What Happens When One Files The Itr Timely V S Those Who Fail To File Their Return By Due Tax Refund Income Tax Income Tax Return

I Haven T Filed Taxes In 5 Years How Do I Start

5 Things To Remember For Us Expats Things To Know Us Tax Infographic

What Should You Do If You Haven T Filed Taxes In Years Bc Tax